35+ Credit card debt payment calculator

Some cards can charge a fee of 3 or 4 of the total amount transferred. We all have heard someone including ourselves say.

Finance Stickers Budget Planning Stickers Bill Check Sticker Etsy Planning Stickers Planner Stickers Free Printable Planner Stickers

Someday Im going to get rid of this credit card debt.

. Your report card shows your grade total late payments and more. Whileeach issuer may have a slightly different policy the common practice is to charge the greater of a. The right way to pay your credit card depends on your budget and financial goals and you might even switch up strategies month-to-month.

6 Best Credit Card Deals of 2022. Utilization is the amount of debt outstanding on your revolving credit sources like credit cards or home equity lines in relation to your available credit. Consumers have started to return to bad habits when it comes to credit card debt.

Have a 4000 balance on a credit card. The OpenSky Credit Card is a good credit card for people with bad credit who want high approval odds because there is no credit check when you apply. Credit age accounts for 15 while credit mix and credit inquiries count for 10 each.

Making the Minimum. Most credit card companies let you make payments using the following four methods. Basically credit card issuers give you both options - to transact beyond the credit limit as well as decline the transaction when crossing the credit limit - you can hence opt in or opt out of over limit transactions at the time of paymenttransaction.

The downside of the OpenSky Card is its 35 annual fee but that can be worth it for the chance to rebuild your credit. Debt Evaluation Calculator Current Expense Calculator. Credit purchase beyond the card limit is generally allowed for all credit card users.

See how long it could take to pay off your credit card debt with Credit Karmas debt repayment calculator. Most debt consolidation loans have fixed interest rates and a set repayment term so your monthly payment will be the same every month unlike monthly payments on credit cards. Consequences of Defaulting on Federal Student Loans.

If the interest on a credit card is 10 pa then interest on a balance of 2000 will be charged monthly on pro rata of that 10 pa. 35 and cross-border fraud outside SEPA 22. Managing Your Credit Card Debt.

Tip if you are running late on your credit card payment you should make payment to credit card companies as soon as you have money in. This is in part because the government provides so many options for paying back student loans that it sees default as an extremely serious issue. Your credit card issuer will require you to make the minimum payment each month.

Payment history makes up 35 of your credit scorethe biggest part. The average value per card payment in the UK is decreasing quickly. Interest on a credit card like a Visa card is charged at an annual rate which is calculated and charged monthly to your credit card balance.

The average credit card interest rate is about 20 and that means any debt left after your minimum payment will grow by 20. Only one type of credit. For example if your balance is 300 and your credit limit is 1000 then your credit utilization for that credit card is 30.

See your payment history now. The average cardholder had 5769 in credit card debt in Q1 2022 up from 5611 in Q1 2021. How do you calculate a credit card payment.

Lots of money-saving credit card deals are available right now but the details change often and the very best credit card deals only last for a limited time. Payment history is the record of whenand ifyou pay your bills. Typically the minimum payment is a percentage of your total current balance plus any interest you owe.

Credit card debt totaled 841 billion in Q1 2022 down from 893 billion in Q1 2020 the last quarter before the pandemic but up 71 billion from Q1 2021. But before you determine which payment method is right for you you need to understand all your options. Credit utilization is the ratio of your outstanding credit card balances to your credit card limits.

30 5 Read full card. It measures the amount of available credit you are using. There is usually a dollar amount for your minimum monthly payment also so it may be expressed as something like 35 or 2 of your balance plus fees whichever is greater.

So if you owe 2000 your minimum payment might be 40. Individuals 75 or older had the most debt 8100 and those under 35 had the least 3700. Get your debt usage now.

Home equity line of credit HELOC calculator. SoFi rate ranges are current as of 82222 and are subject to. Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score.

Some cards may restrict your grace period when you dont pay your statement balance in full so any. Free credit card calculator to find the time it will take to pay off a balance or the amount necessary to pay it off within a certain time frame. Defaulting on a federal student loan can come with even heftier consequences.

And its one of the main things that creditors look at. Before you default on a student loan you have options such as deferment and. Following a record-setting reduction in 2020 consumers added a total of 862 billion in new credit card debt to their tab during 2021 capped off by a 731 billion increase during the fourth quarter alone.

See your payment history. This is because credit card debt. By making on-time or early paymentsyour payment history makes up.

Men own 29 more credit card debt than women 7407 vs. By taking the proceeds of a personal loan to pay off credit card debt you can eliminate multiple monthly high-interest card. A high credit limit.

Credit card debt surpassed 1 trillion in 2017 and was at 868 billion as of August 2019. Use too much and your score goes down. Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount.

If youve only handled one type of debt such as a credit card or a student loan. The best credit card deals include initial rewards bonuses worth 500 0 intro APRs for as long as 15-21 months and 0 fees for the first year or longer. After which the credit card will require payment of interest on top of the principal.

In the most widely used credit scoring system FICO payment history counts for 35 of your score while credit utilization counts for 30. How you use credit affects your credit score. Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score.

Alaska 6910 has by far the highest debt ahead of Colorados 5625 and Connecticut 5617. With a secured credit card your payment history and credit.

Top 100 Personal Finance Blogs Top Finance Bloggers 2022

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Best Personal Loans In Cleveland Oh Top Lenders Of 2022 Moneygeek Com

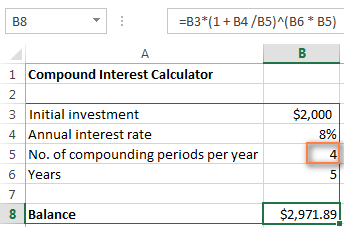

Compound Interest Formula And Calculator For Excel

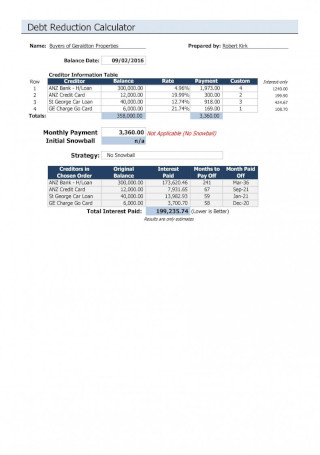

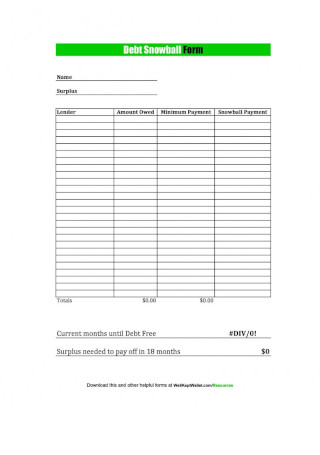

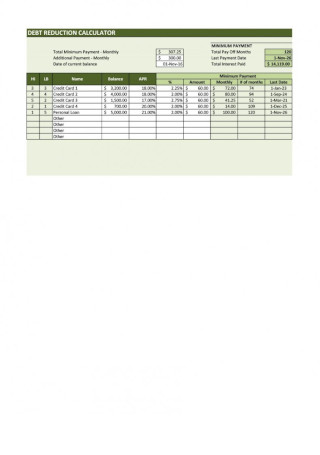

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Grocery Budget Calculator Is Your Grocery Budget Out Of Control

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

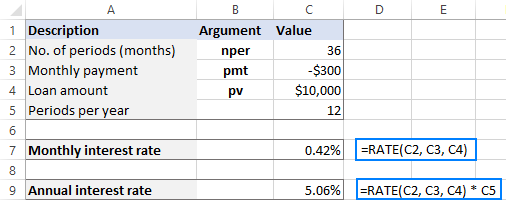

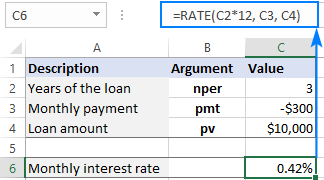

Using Rate Function In Excel To Calculate Interest Rate

35 Sample Debt Snowball Spreadsheets In Ms Excel Pdf Ms Word

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

I Am In Student Debt By 100k And Just Got My First Job In Nyc From Which I Will Earn 95k Annually What Financial Advice Would Be Most Useful For Me

Average Down Payment For A House Here S What S Normal

Using Rate Function In Excel To Calculate Interest Rate

Deals On Twitter Planejamento Financeiro Objetivos Financeiros Lista De Convidados De Casamento

Formalbest Of Self Employed Tax Deductions Worksheet Check More At Https Www K Business Tax Deductions Small Business Tax Deductions Monthly Budget Template

Sales Commission And Costing Calculators Templates Excel Templates Statement Template Excel Templates Mission Statement Template

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey